Bryan Jones, CPA and Friend to Musicians

Once a year in Nashville I go see Bryan Jones, partner at CPA Consulting Group, to talk about taxes. It's much better than my annual visit to the dentist, not only because Bryan knows his stuff but also because we talk about music and generally how things have gone over the last year. And, because a lot of what we discuss about applies to all musicians, songwriters and artists, I asked Bryan for a few tips for you too!

What should artists and musicians be thinking about when it comes to taxes?

The first thing is determining if it's a hobby or a business. The IRS will be asking these questions:

a. Does the time and effort put into the activity indicate an intention to make a profit?

b. Does the taxpayer depend on income from the activity?

c. If there are losses, are they due to circumstances beyond the taxpayer’s control or did they occur in the start-up phase of the business?

d. Has the taxpayer changed methods of operation to improve profitability?

e. Does the taxpayer or his/her advisors have the knowledge needed to carry on the activity as a successful business?

f. Has the taxpayer made a profit in similar activities in the past?

g. Does the activity make a profit in some years?

h. Can the taxpayer expect to make a profit in the future from the appreciation of assets used in the activity?

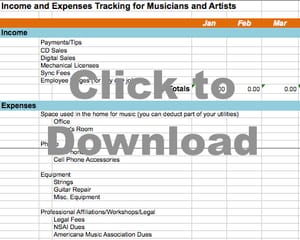

If the answer is yes to these questions, you need to make sure keep track of your receipts and deductions. (Side note from Shantell: download this Tax Organizer to help!)

What are some common deductions that musicians can take?

To be deductible the IRS says the expense must be ordinary and necessary. Here are some common deductions we see:

a. Equipment/instruments

b. Lessons

c. Office supplies

d. Travel

e. Subscriptions to trade magazines

f. Music business books

g. Fees for website and email marketing etc

h. Memberships in professional organizations and associations

i. CD/tape duplications, photos & bios

j. Home office

k. Rent for equipment storage

l. Contract labor/musicians

Also remember that if you pay someone more than $600 per year for sevices, for example a musician that is in your band, you’ll need to get a W-9 for each of thesepeople (preferably before you pay them), fill out a 1099 MISC form and send to them, then file a 1096 with the IRS. (Side note from Shantell: This sounds a little complex, but its actually pretty easy. I think this YouTube video breaks it down really well).

At what point do you know you need to hire an accountant?